BBGA to oppose further changes to Air Passenger Duty into 2015

Tuesday 23rd September 2014

The British Business General Association Association (BBGA) pledged today it will oppose further increases to the current air passenger duty (APD). Earlier this year the Association was notified of potential changes to the current APD charging process. Such proposals have simplified the charging process for scheduled airlines and indeed reduced APD charges in that sector, which are still the highest in Europe. In contrast, however, business aviation has been specifically targeted to pay more. The proposed increased charges next year are considerably higher, in terms of the specific amount and the additional cost, owing to banding changes.

For example, while the majority of outbound sectors are currently charged at a rate of £276 per passenger, from Apr 15th 2015 they will be charged £427 per passenger = a 54% increase. In contrast first class airline passengers will enjoy significant reductions on legs above 4,000 miles - a situation, states BBGA, which is unfair and inequitable."

Speaking at BGAD Cambridge today, 23rd September, BBGA CEO Marc Bailey said: "The proposal for charges to business aviation aircraft with MTOW above 20,000Kg is neither fair nor balanced. "We thought initially that the Treasury had made a change that adversely impacted on business aviation as an unintended consequence. Now it is clear that, using an arbitrary threshold, the Government has deliberately chosen to tax our clients. Our sector has been penalised because of "the relative spaciousness and comfort merits such as a progressive approach to rates, compared with commercial aircraft that have a higher seating density, or less overall cabin space." according to Priti Patel MP, Exchequer Secretary to the Treasury.

Furthermore, unlike the previous APD discussions in 2012, BBGA was not consulted either formally or informally. "This whole process undertaken by the Treasury, is duly completely unacceptable and unfair from an industry perspective," Marc Bailey concluded.

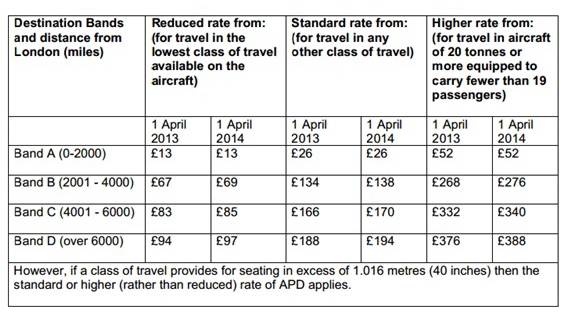

Current APD Charging:

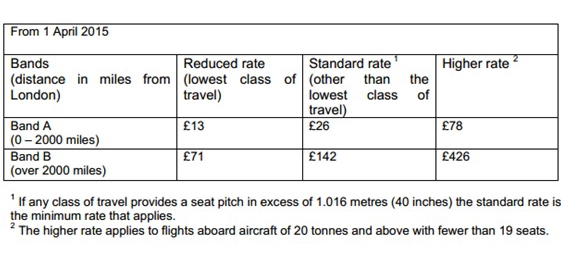

Proposed APD charging:

These tables above demonstrate how much charges will increase on larger business aircraft flying missions beyond 2,000 miles and how much higher they will be than the standard rate ( ie that charged for a scheduled airline's First or Business Class Seat). While the BBGA does not object to the scheduled airlines receiving a reduction in APD (it advocates a full abolition of APD for all operators in aviation.) we do object to the arbitrary selection of 20,000Kgs as the point at which the higher rate tax is imposed."

The majority of passengers using these aircraft are not flying for leisure, rather they are travelling on business. Only a small proportion of these flights are used by what the Government calls 'High Net Worth individuals'. Secondly the nature of UK operations is such that many of the aircraft sectors completed outbound falls into Band B operations.

BBGA is now recommending that it takes the opportunity to lobby their local MP's and government contacts. "If we allow such changes to be implemented, along with other increased charges on our sector, we will soon find that our market is under threat, seriously damaging not only our own business but also inward investment and regional development in the UK."

Latest News

Wednesday 19th February 2025

ACIA Aero Leasing places ATR72-500 Bulk Freighter with Canada’s KF Aerospace

Wednesday 19th February 2025

Serious consequences for charters operating without a valid UK Foreign Carrier Permit, warns BBGA

Get Social

Twitter Linked in Facebook Instagram